8 Brands Increasing Digital Spending: Q3 2021

If you’re hoping to reach brands boosting spend, Winmo has the scoop. We’ve outlined eight brands increasing digital spending so far in Q3 2021 that our customers are paying attention to now. Plus, digital buying intelligence from Pathmatics (available with Winmo Pro) highlights daily spending across desktop display, mobile display, mobile video, desktop video, Facebook, Twitter, and Instagram.

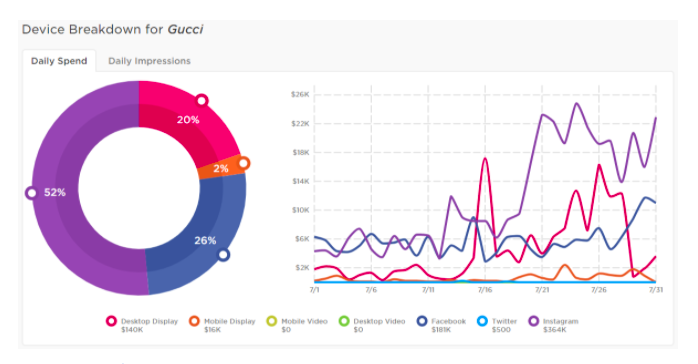

1) Gucci

Gucci tends to target women, especially Gen-Z, which is obvious by its sharp increases in digital spending and reliance on Facebook and Instagram advertising for its latest jewelry line. To reach this digitally-oriented audience, Gucci’s new brand engagement head could lead it to expand into additional digital channels such as podcasts and/or OTT. Per Kantar data, Gucci also invests in print and OOH advertising. However, its overall spend in these channels has declined notably over the past couple of years.

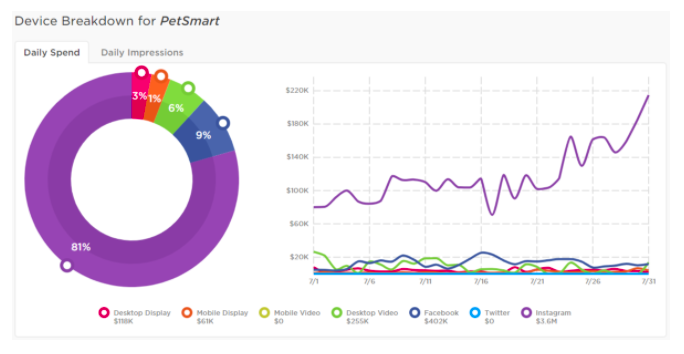

2) PetSmart

People stuck at home adopted more pets than ever last year, so the pet care industry became more crowded in response. “Anything for Pets” was developed by AOR, Deutsch LA. This campaign reportedly is a substantial investment and PetSmart is already spending more on marketing this year than last. According to Kantar data, the brand additionally invests in radio, OOH, print, and local broadcast.

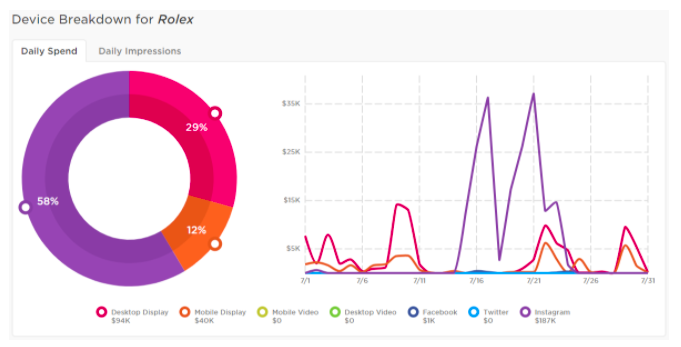

3) Rolex Watch USA

According to Winmo’s intent insights from Bombora, Rolex has shown extreme interest in website publishing this week. Additionally, the luxury watch company has also shown interest in adtech, branding CRM, education, entertainment, event management, mobile, sales, and strategy.

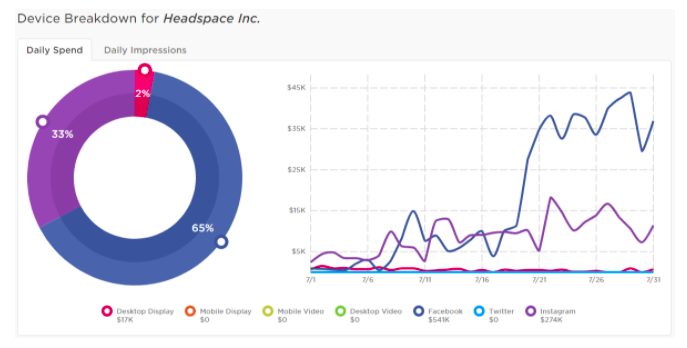

4) Headspace Inc.

The company recently teamed up with Whole Foods on a mindful cooking tip video series via IGTV. The “Food for Mood” digital recipe events and virtual classes connect shoppers while promoting both brands. Mental health problems spiked in consumers this past year, so meditation and breathwork services like Headspace surged in demand. The company targets Gen-Z through its sharp increase in digital spending and reliance on Instagram, Facebook, and OTT advertising. Headspace has also recently shown interest in email marketing.

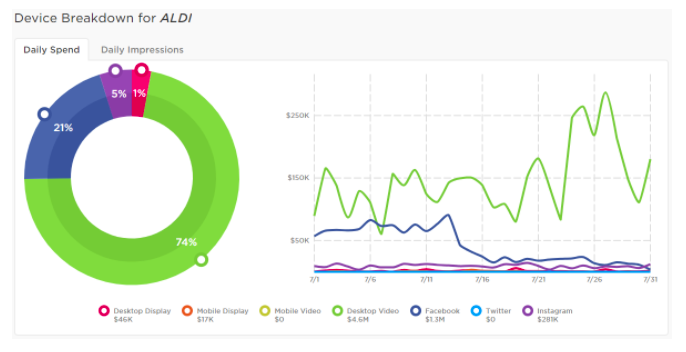

5) ALDI

Discount grocery store chain ALDI experienced a significant surge in digital ad spend, particularly across paid social channels, in 2020, that continues throughout 2021. The company also has aggressive expansion plans for the rest of the year. It already operates 2k+ locations in 37 states and plans to open 100 in Arizona, California, Florida, and the northeast. Additionally, it will add 500 curbside pickup sites to continue offering social distancing options.

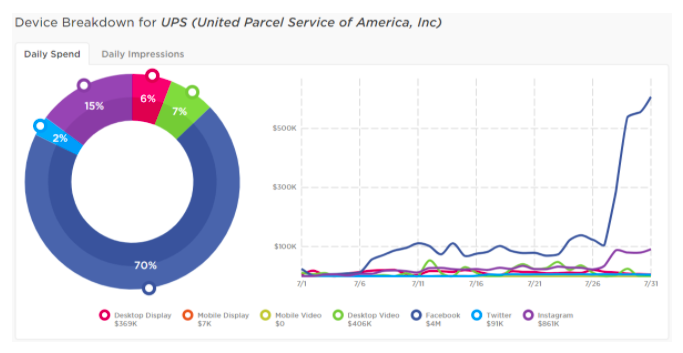

6) UPS

According to Winmo’s intent insights from Bombora, UPS has shown interest in adtech, agencies, reporting, branding, event management, and search marketing this week. Additionally, the package delivery company has also shown interest in email marketing and entertainment.

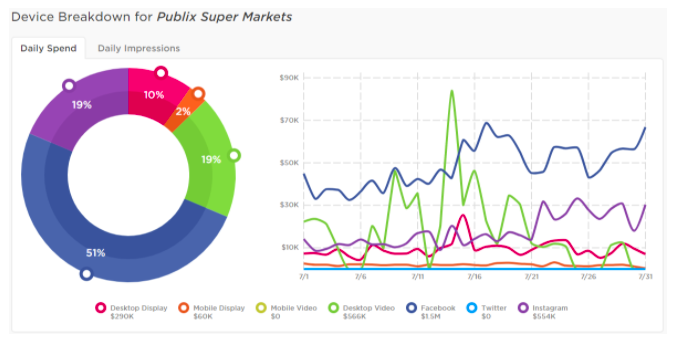

7) Publix

Evidently, Publix is shifting from a primarily Gen-X and older millennial target audience, to focus on younger millennials and Gen-Zers. As always, grocery stores like Publix focus heavily on reaching women, because moms are the primary shoppers for many families. It also invests in OOH, print, radio, and local broadcast TV ads, per Kantar. Sellers should reach out offering digital ad space.

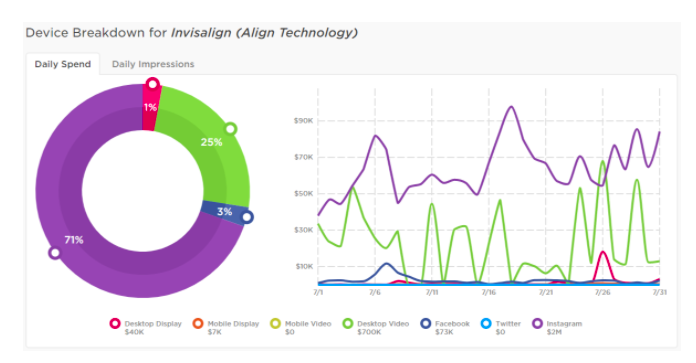

8) Invisalign

InvisAlign seems to be targeting millennials and Gen-Zers with a male skew by increasing digital spending. It reaches these demographics through digital display and national TV ads. The company has been increasing spend for a couple of years now, and has continued pumping dollars into these channels so far this year. The company started ramping spend up in 2019 and kept adding dollars to these channels during the pandemic.

Want in on these budgets?

If you liked this blog post, check out:

- How I Applied WinmoEdge Insights as an Agency Client

- List Download: 40+ NBA Team Sponsors in 2021

- Can Blockchain Standardize the Adtech Industry?