4 Brands Reallocating Social Spend From Facebook

Where’s the line between profit and activism? That’s the question 200+ companies asked themselves in July when they pulled $7 billion in social spend from Facebook, boycotting the platform until it addressed concerns over civil rights, diversity, and conspiracy-mongering.

First it was Patagonia and REI, then came Honda, Verizon, and Coca-Cola. These multi-million dollar spenders announced they were pausing advertising from the platform (some until the end of the year), standing in solidarity with Stop Hate For Profit and Color of Change.

With 1.49 billion (with a b) daily active users, advertising on Facebook has become a necessary ad strategy for companies of all sizes. The platform’s micro-targeting features allow brands to reach their exact desired audience, getting in front of the people who are most likely to engage. And they’re willing to pay up — we reported last month that HBO spent $44,059,200 on Facebook alone in Q3, earning 5,888,031,400 impressions.

Most boycotting brands plan to maintain their total planned media investment for the year. Based on the ad revenue Facebook lost, billions of dollars have been freed up. But where are they going to spend it now? Publishers should aggressively pursue these social budgets while brands are deciding where to reallocate the funds.

Here are four brands reallocating social spend from Facebook. Publishers, take note:

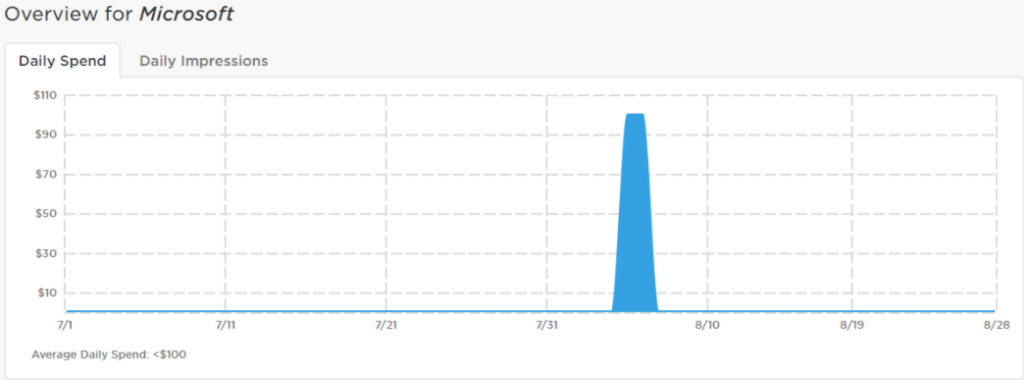

1) Microsoft: The software giant did have one day of spending before settling back into the boycott.

Microsoft tapped MGID as its global native advertising partner last month. MGID will be responsible for placing ads across Microsoft’s network of over 1,200 news outlets such as MSN. This will allow Microsoft to reach its target audience more effectively. The company also plans on releasing a new Xbox console near the end of this year, though not confirming a release date. Regardless there should be extra ad dollars out there for sellers this holiday season.

- Sellers – Microsoft targets a wide audience of consumers including Gen-Z, millennials, and Gen-X, reaching audiences through national TV and digital display ads. It also invests in local OOH and print ads, per Kantar. Look for extra Xbox ad dollars beginning in Q4 and continuing throughout 2021 as it promotes the new Xbox console. This will appeal to Gen-Z and millennial males.

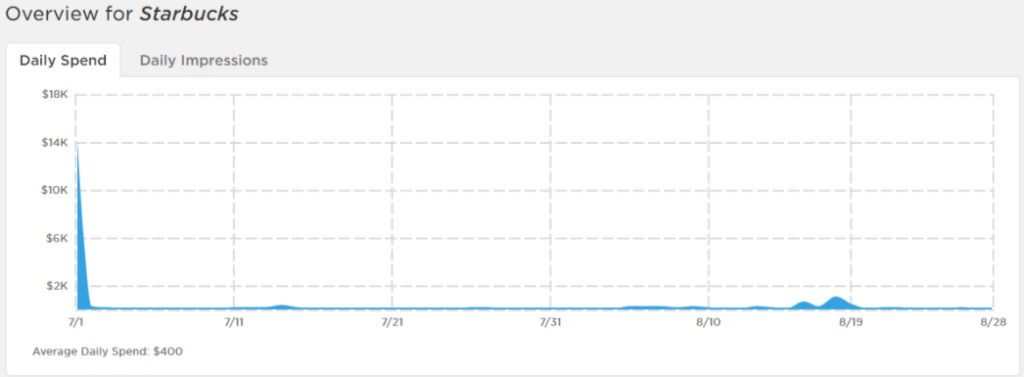

2) Starbucks: Minimal Facebook spending since July 1, 2020.

Of course, Starbucks will advertise heavily this fall around the Pumpkin Spice Latte and other seasonal drinks. Additionally, it will add more ways to pay and earn rewards via its app, which also now offers consumers the option to buy drinkware virtually. So far this year, Pathmatics estimates Starbucks has generated 4.1b digital impressions. With all of the upcoming holiday advertising, we may see Starbucks’s full-year 2020 spend end up growing overall.

The company tends to target a wide range of consumers ranging from Gen-Z to Gen-X, with a slight female skew, but lower digital ad spend and higher national TV spend lead us to believe it’s especially focused on millennials and Gen-X at this point. Kantar data reports Starbucks also utilizes OOH and local broadcast but, at least as of Q1 2020, hasn’t invested in search, print or radio since 2019.

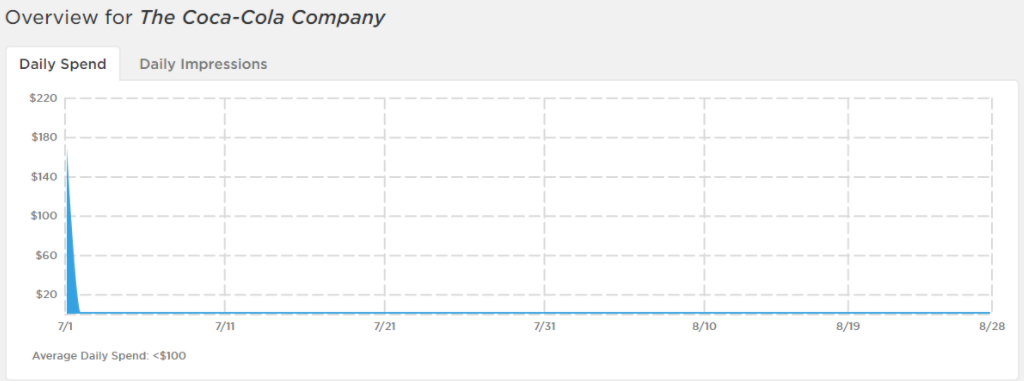

3) Coca-Cola: No Facebook spend since July 1, 2020.

Execs reported in the company’s Q2 2020 earnings that they were reassessing their overall marketing ROI “on everything from ad viewership across traditional media to improving effectiveness in digital.” Coca-Cola temporarily paused spending due to COVID, but its overall ad spend is still relatively low. According to Pathmatics, Coca-Cola utilizes paid social, allocating around $3.2m toward Twitter ads and $349k toward Instagram ads.

- Sellers – Coca-Cola invests in local marketing methods such as OOH, print and radio ads. They mainly target Gen-Z and millennials with a slight female skew through digital display and national TV ads, heavily focusing content on their sustainability efforts.

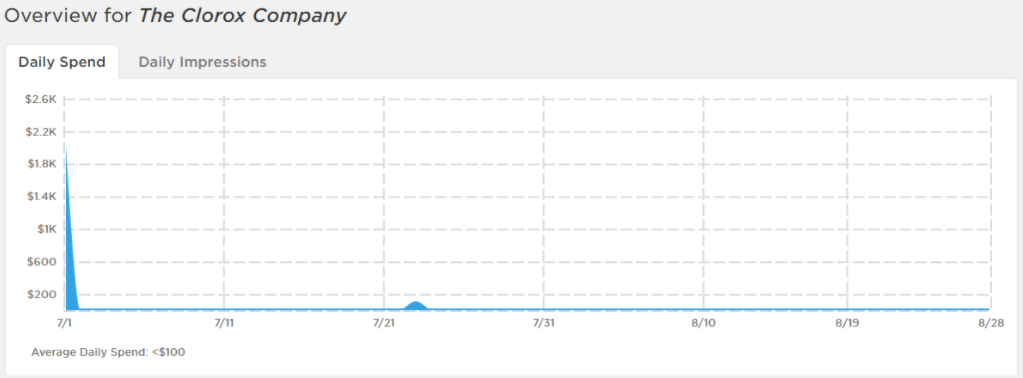

4) Clorox: Minimal Facebook spending since July 1, 2020.

Clorox boosted its ad spend by $50 million due to the surge in disinfectant demand due to the global pandemic. Its sales rose almost 15% YOY in its fiscal Q3 (FY closed in June) and donated $14 million in COVID-19 relief efforts. The company also has the following virus-related goals:

- Protecting its employees’ health, safety and well-being

- Maximizing supply

- Supporting caregivers and others impacted most by the pandemic

Clorox is targeting Gen-Z and millennial parents with its rising display ad spend. According to Kantar data, the company also utilizes search, OOH, print (magazines), radio and local broadcast.