Name Image and Likeness (AKA NIL): What’s all the BUZZ about?

For more than 150 years, college athletes have generated billions of dollars for the National Collegiate Athletic Association (NCAA) without being able to monetize on their own likeness. On July 1st, 2021, a Supreme Court ruling allowed athletes to make a profit for the first time in history.

In the past 11 months, a variety of opportunities have surfaced in the hottest emerging industry known as name, image, and likeness (NIL). NIL is predicted to evolve into a multi-billion dollar industry in college sports during the next few years. University collectives, marketplaces, and agencies play a major role in positioning athletes to be successful off the field.

Breaking down the industry

University collectives, two-sided marketplaces, and agencies are only a few niche categories of the 300+ NIL specific businesses that have sprouted up around the country. Here’s a breakdown of each of the categories:

- University collectives are a third party, consisting of boosters and businesses that pool together funds to facilitate deals and help athletes grow their personal brands. Top collectives such as ‘Division Street’ at Oregon, ‘The Gator Collective’ at Florida, and ‘Spyre Sports Group’ at Tennessee have raised millions of dollars.

- Two-sided marketplaces connect athletes and brands on a platform to create deals. Leading marketplaces include, OpenSponsorship, INFLCR, Opendorse, IconSource, MarketPryce, MOGL, Playbooked, and MatchPoint.

- Agencies represent individual athletes, negotiating deals on their behalf. First Round Management, MAGZ Sports Group, NIL Management, Oncoor Athlete Marketing, and Rosenhaus Sports have signed more than fifteen athletes.

All options give student athletes the opportunity to profit, however they’re all missing out on one key component: THE DATA.

How much are college athletes really worth?

The billion dollar question is how to determine the fair market-value of a college athlete.

Many have tried and there are differing opinions on which metrics to use. Tracking an athlete’s social media following and engagement has been standard, mirroring influencer marketing. However, with the ability to manipulate follower count, according to Hootsuite*, coupled with the fact that social media alone can’t determine an athlete’s impact, , these metrics no longer tell the entire story.

Top NIL earners

Data from previous NIL deals, disclosed by Opendorse*, display the lopsidedness of the industry. While the top one percent of athletes have signed five, six and seven figure deals, the average yearly compensation at the Division 1 level is $3,711 per athlete.

Athletes such as Bryce Young (Alabama Football), Paige Beuckers (UCONN Women’s Basketball), and Shareef O’Neal (LSU Basketball) have cashed in over the past year. Alabama Football Head Coach, Nick Saban, revealed that Young made nearly $1 million in NIL endorsements during the first month of regulation.

While athletes monetize off of individual endorsements, university collectives have focused on fundraising from boosters and local businesses. Ohio State Football Head Coach, Ryan Day, stated that it would cost $13 Million in NIL deals to keep their current roster of players from transferring*. The top individuals and teams command millions of dollars of endorsements in the new era of collegiate sports. BuzzU Founder Zach Novoselsky has devised a solution that he believes will measure how buzzworthy each athlete is across the country.

As a former college football player, Zach realized that only the top 1% of athletes would be able to monetize on their NIL. Without representation, college athletes would have no way to value themselves, and they lack the knowledge of how to navigate these uncharted waters.

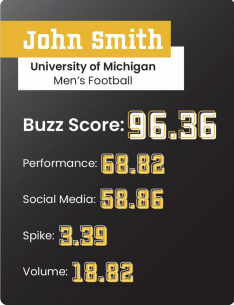

Since its conception 16 months ago, BuzzU has put all of its resources and efforts toward determining a fair market value otherwise known as a Buzz Score.

“Buzz Scores are easy to understand solutions that provide advertisers and businesses with the ability to leverage NIL. Analytics are a necessity in the advertising space and we are bringing them to the world of college athletics,” Novoselsky said.

To date, BuzzU has gathered Buzz Scores for more than 20,000 athletes across the top four revenue generating sports: Men’s Football, Women’s Basketball, Men’s Basketball, and Women’s Volleyball. These 4 sports account for more than 86% of total NIL revenue.

To date, BuzzU has gathered Buzz Scores for more than 20,000 athletes across the top four revenue generating sports: Men’s Football, Women’s Basketball, Men’s Basketball, and Women’s Volleyball. These 4 sports account for more than 86% of total NIL revenue.

Determining the value of a Buzz Score:

A Buzz Score is a unique local marketability rate out of 100, and is updated weekly. The algorithm uses machine learning to compute these scores by pulling from four key data sources:

- Analytics from on-field performance statistics

- Social media using sentiment analysis

- Search engine spike trends over the past month

- Search engine volume trends over the past year

A Buzz Score consists of data from performance, social media, and search engines to create a comprehensive overview of how buzzworthy each athlete will be.

Helping brands maximize ROI for athlete campaigns

The value of a college athlete continues to increase year over year. It is important now, more than ever, that brands capitalize on this NIL opportunity. With Buzz Scores, brands can accurately tailor their campaigns and maximize ROI.

Opportunities for marketing and advertising

A majority of NIL engagements consist of social media sponsored posts, appearances, autograph sessions, and licensing rights. Nevertheless, deals can look vastly different. For example, the entire Virginia Tech Offensive Line secured a sponsorship deal to get paid a weekly meal of barbecue, courtesy of Mission BBQ in Christiansburg. Paige Beuckers, of UConn Women’s Basketball, made history as the first collegiate athlete to be endorsed by Gatorade. And Saint Peter’s Guard, Doug Edert inked a deal with Buffalo Wild Wings after his March Madness heroics.

As referenced, there are countless ways to structure an NIL sponsorship. The companies who are still on the sideline, are missing out on this vital opportunity.

Future of NIL

The industry of name, image, and likeness will see several changes in the coming years. There will be an increase in popularity to broker group deals, and include multiple athletes in a single campaign. Currently, only nine states allow high school athletes to monetize off of their likeness. High school legislation will change throughout the country, to allow for widespread adoption of NIL. Additionally, mergers and acquisitions will take place for marketplaces and agencies. Best practices will be defined, and creating a fair market value will be essential. BuzzU is the solution to leverage the opportunity of NIL.