Winmo is constantly adding new advertisers and agencies to our database… That’s why we’re the most comprehensive resource for finding advertising, brand contacts, and media spend tracking. Backed by an in-house research team that pairs technology and human insight to cultivate and verify targeted information on a daily basis, we’re constantly tracking the client and agency-side decision-makers responsible for North America’s top brand budgets. From CMOs to media planners, emails to direct dials, our team is verifying a large span of data to bring you accurate insights to empower you to win more business.

Check out three brands ramping up their Google Ad spending, including upcoming campaigns, spending insights, agency relationships, and more…

1) JCPenney

JCPenney announced a $1 billion reinvestment plan to improve the customer experience and operations. It will completely renovate about 100 stores while some will need only a light refresh. The retailer will also update its website and mobile app with new features such as an improved search function, product details, customized styling recommendations, and customer reviews. Additional funds will go toward merchandising, supply chain, and technology improvements. This project follows Katie Mullen’s hiring as chief customer officer in April.

JCPenney is launching an accompanying ad campaign called “Make It Count” targeting Millennial and Gen-X mothers. The push includes multiple TV spots as well as digital, social, in-store, and print ads. The company’s in-house team handled creative, and Yard took care of brand positioning.

JCPenney will likely:

- Continue shifting ad dollars from TV to digital channels

- Significantly increase ad spend

- Seek new agency partners

Digital and social insights (digital ad spend, effectiveness, impressions, and performance)

- YTD spend: JCP spent approximately $18m on digital display ads YTD, a 7% jump from $16.9m spent in this channel during the same time period of 2022.

- YTD data: 2.5b impressions via Facebook (47%), YouTube (26%), Instagram (15%), and desktop display (12%).

- 2021-2022 spend: Full-year spending increased by 9% from $31.3m in 2021 to $34.2m in 2022.

- Ad location: It placed 94% of these ads directly onto sites such as facebook.com, youtube.com, instagram.com, yahoo.com, and msn.com. It placed 6% of these ads through multiple indirect channels onto sites such as yahoo.com, seriouseats.com, realtor.com, msn.com, and espn.com.

- Google Adwords spend: JCPenney spent almost $6 million in Ad spend from May to July 2023, most likely in an attempt to increase web traffic for the back-to-school and holiday shopping seasons. Interestingly, traffic peaked in November 2022 with 1.1 million site visitors and all of the summer spending didn’t meet the same engagement all combined.

Agency analysis: The reinvestment project may lead to agency reviews, so get in touch now to secure top priority. Current roster: dentsu X: media AOR; 360i: digital AOR; YARD: brand positioning; In-house creative.

2) Equinix, Inc.

Equinix hired Adam Berlew as CMO in September 2023. Berlew joins from Atlassian, where he served as head of global digital, enterprise, economy, and platform marketing. This is his second stint with the global data service provider, having served as global marketing VP from 2012 to 2015. As CMO, Berlew is tasked with implementing a marketing strategy to increase revenue and drive customer acquisition.

Equinix will likely:

- Keep increasing ad spend

- Review the current agency roster

- Experiment with new ad channels

Digital and social insights (digital ad spend, effectiveness, impressions, and performance)

- YTD spend: Equinix spent about $348.7k on digital display ads YTD, a 47% increase from $236.6k spent in this channel during the same time period of 2022.

- YTD data: 66.4m impressions via desktop display (88%), Facebook (6%), mobile display (5%), and YouTube (1%).

- 2021-2022 spend: Full-year spend jumped from $265.3k in 2021 to $637k in 2022.

- Ad location: It placed 60% of these ads through multiple indirect channels onto sites such as politico.com, yahoo.com, ew.com, rollingstone.com, and washingtonpost.com. It placed 40% of these ads directly onto sites such as facebook.com, cio.com, yahoo.com, washingtonpost.com, and theathletic.com.

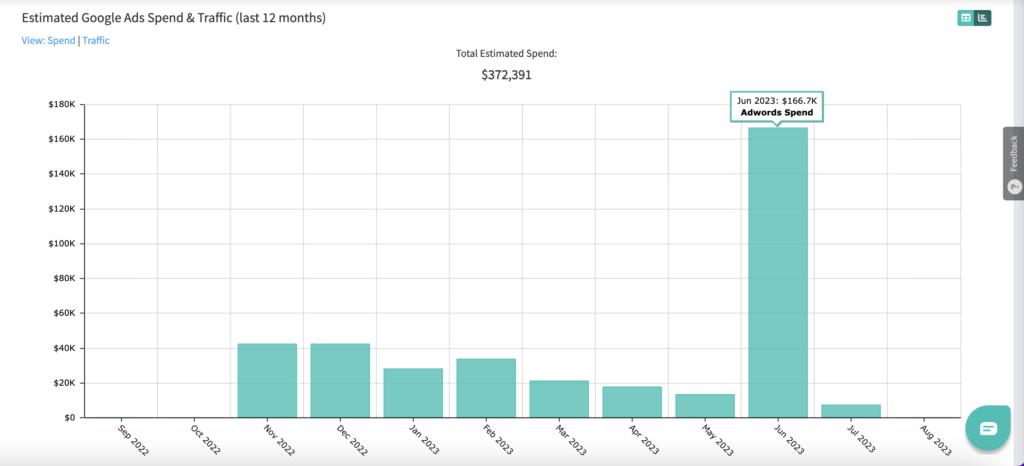

- Google Adwords spend: Prior to June 2023’s $166.7k spend, Equinix’s Google Ads spend peaked at $42.3k in December 2022. Monthly traffic hovered around ~5k visitors from Google Ads until June’s jump to 23k visitors.

Agency analysis: Contact the new CMO now to be top-of-mind. Current roster: Addis Group for Creative; Karbo Communications for PR

3) Small but mighty: 686

Apparel brand 686 selected Backbone as its PR, affiliate, and influencer management AOR. The streetwear brand targets Gen-Z and millennial men and appointed Elan Maj as its senior growth marketing manager in June 2023.

686 will likely:

- Launch a new campaign

- Keep increasing spend

- Pursue new influencer partnerships

- Seek additional new agency partners

Digital and social insights (digital ad spend, effectiveness, impressions, and performance):

- YTD spend: So far this year, 686 has spent approximately $680.8 on digital ads, almost double the approximately $380k spent within the same 2022 timeframe.

- YTD data: The company has earned roughly 99m digital impressions YTD, 60% via Instagram ads and 40% via Facebook ads.

- Last year: In 2022, 686’s estimated full-year spend decreased slightly (less than 1%) to $927.4k from that of $928.3k in 2021.

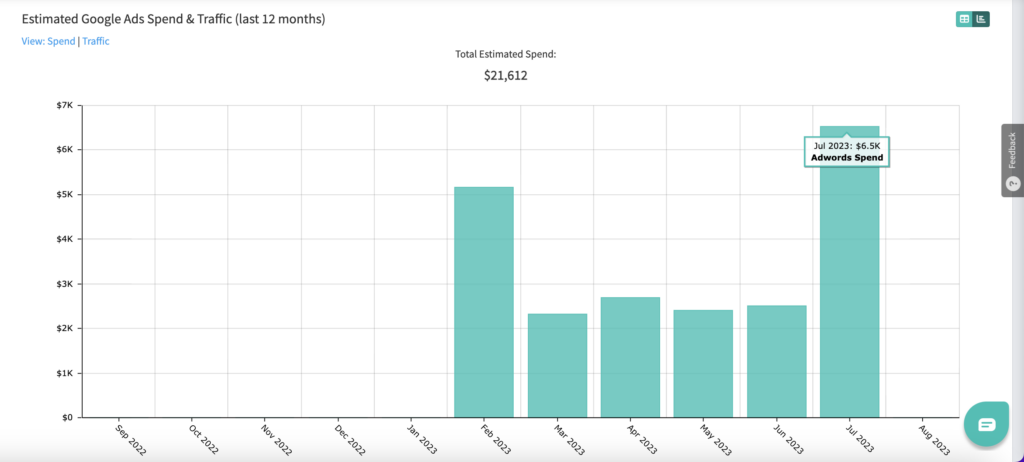

- Google Adwords spend: 686 kicked off their spend in February 2023, spending $5.2k, before hovering around a $2.5k monthly spend until July’s $6.5k uptick. Traffic also peaked in February and remained stationary throughout the summer. Q3’s push may be an effort to go after back-to-school and holiday shoppers.

Additional agency insights: Agency reviews often follow one another, so reach out soon to offer creative, media, digital analytics, social media management, multicultural, and/or experiential services.